Your Business Made Simple

Payment Solutions

Accepting credit and debit cards is an essential part of your business.

With Simpay’s Payment Solutions, you accept payments securely and conveniently in-store, online, or wherever you do business.

Payroll & HR Solutions

Growth Solutions

You’ve worked hard to build your business and your brand, now it’s time to reap the rewards.

From gift & loyalty programs to business funding and digital marketing services, we’ve got you covered.

The Simpay

Guarantee

Bundle up with flexible contract terms and transparent pricing.

We guarantee our performance – if you ever find that we’ve fallen short and cannot help you, we won’t hold you to a contract.

The Simpay

Guarantee

Bundle up with flexible contract terms and transparent pricing and enjoy support when you need it, where you need it. We guarantee our performance – if you ever find that we’ve fallen short and can not help you, we won’t hold you to a contract.

Simpay makes outsourced business solutions easy, simple, and affordable.

Simpay makes outsourced business solutions easy, simple, and affordable.

Our vision is to simplify your business. We work with you to analyze your needs and tailor solutions to help your business run smoother and promote your business growth.

By creating intuitive and easy-to-use programs designed to save you time and money, we deal with day to day business operations, so you don’t have to.

We serve you as we would a family member – providing personalized service and flexible solutions to fit your needs, not ours.

Come and experience the difference with Simpay.

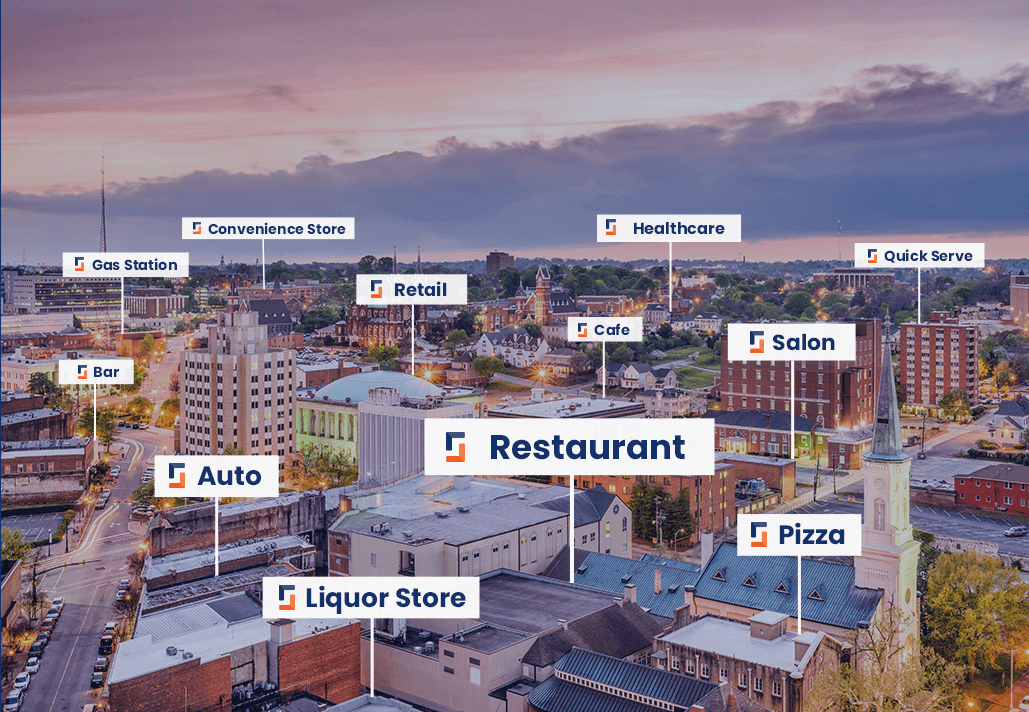

Solutions for Any Industry

Whether you’re saving lives in the healthcare industry or feeding your community at your locally owned restaurant, we offer comprehensive solutions for any business.

Want to learn more about Simpay Total Business Solutions?

Simpay Adds Timothy Toombs to the Executive Sales Leadership Team

Experienced leader to oversee multiple sales & distribution channels TREVOSE, Pa., March 20, 2024 – This week, Simpay expanded its

Simpay and Dejavoo Renew Their Strategic Business Partnership

The partnership aims at providing merchants with a comprehensive business solution to drive sales and increase growth. Mineola, NY –

Does My State Allow Dual Pricing or Surcharging?

Dual pricing and surcharging both offer a way for merchants to offset the cost of credit card processing fees. But

Let’s Take the First Step Together.

It’s time to be treated the right way, the Simpay Way.